What Time Does The Stock Market Open? A Comprehensive Guide

Understanding the opening hours of the stock market is crucial for anyone involved in trading or investing. Knowing what time does the stock market open allows traders to plan their strategies, execute timely trades, and stay informed about market fluctuations. This guide provides a comprehensive overview of the stock market’s opening hours, factors that can affect them, and essential information for both novice and experienced investors. We will delve into the specifics of the major exchanges and explain how different timings can impact your investment decisions. So, if you’re wondering, what time does the stock market open, read on for a detailed explanation.

Regular Trading Hours: Setting the Standard

The standard trading hours for the major stock exchanges in the United States, including the New York Stock Exchange (NYSE) and the Nasdaq Stock Market, are 9:30 a.m. to 4:00 p.m. Eastern Time (ET). These hours represent the core trading session when the majority of transactions occur. This timeframe is crucial for traders and investors as it provides the most liquidity and price discovery. Understanding these regular hours is the first step in effectively navigating the stock market.

New York Stock Exchange (NYSE)

The NYSE, often referred to as the “Big Board,” is one of the world’s largest stock exchanges. Its regular trading hours are strictly observed. The opening bell at 9:30 a.m. ET marks the official start of trading, and the closing bell at 4:00 p.m. ET signifies the end. These bells are symbolic and represent the beginning and end of the main trading session.

Nasdaq Stock Market

Nasdaq, another major stock exchange, also adheres to the 9:30 a.m. to 4:00 p.m. ET trading hours. Known for its focus on technology companies, Nasdaq plays a pivotal role in the global financial market. Just like the NYSE, understanding what time does the stock market open, specifically Nasdaq, is essential for tech-focused investors.

Pre-Market Trading: An Early Opportunity

Before the regular trading session begins, there is a pre-market trading period. This session typically runs from 4:00 a.m. to 9:30 a.m. ET. Pre-market trading allows investors to react to overnight news and events that may impact stock prices. However, it’s important to note that pre-market trading often has lower liquidity and wider spreads, which can lead to increased volatility. Knowing what time does the stock market open for pre-market trading can give seasoned investors an edge, but it also comes with added risk.

Advantages of Pre-Market Trading

- Reacting to News: Pre-market trading allows investors to react quickly to earnings reports, economic data releases, and other significant news events that occur outside of regular trading hours.

- Potential for Profit: If an investor anticipates a stock’s price will move significantly based on overnight news, they can potentially profit by trading in the pre-market session.

Disadvantages of Pre-Market Trading

- Lower Liquidity: Pre-market trading typically has lower trading volumes, which can make it difficult to buy or sell shares at desired prices.

- Wider Spreads: The difference between the buying and selling price (the spread) is often wider in pre-market trading, which can reduce potential profits.

- Increased Volatility: Due to lower liquidity, pre-market trading can be more volatile than regular trading hours.

After-Hours Trading: Extending the Trading Day

Following the close of the regular trading session, after-hours trading takes place. This period typically runs from 4:00 p.m. to 8:00 p.m. ET. Similar to pre-market trading, after-hours trading allows investors to react to news and events that occur after the market closes. However, it also shares the same risks of lower liquidity, wider spreads, and increased volatility. Understanding what time does the stock market open and close, including after-hours sessions, is crucial for comprehensive market awareness.

Advantages of After-Hours Trading

- Reacting to News: After-hours trading allows investors to react to news releases, such as earnings reports, that occur after the market closes.

- Flexibility: Investors who are unable to trade during regular market hours can use after-hours trading to manage their portfolios.

Disadvantages of After-Hours Trading

- Lower Liquidity: After-hours trading typically has lower trading volumes, which can make it difficult to buy or sell shares at desired prices.

- Wider Spreads: The spread between the buying and selling price is often wider in after-hours trading.

- Increased Volatility: Due to lower liquidity, after-hours trading can be more volatile than regular trading hours.

Factors Affecting Stock Market Hours

While the standard trading hours are generally consistent, there are certain situations that can affect what time does the stock market open or close. These include holidays, early closures, and special events.

Holidays

The stock market is closed on several federal holidays throughout the year. These holidays include:

- New Year’s Day

- Martin Luther King, Jr. Day

- Presidents’ Day

- Good Friday

- Memorial Day

- Juneteenth National Independence Day

- Independence Day

- Labor Day

- Thanksgiving Day

- Christmas Day

If a holiday falls on a weekend, the market may close on the preceding Friday or the following Monday. It’s always best to check the official NYSE and Nasdaq websites for specific holiday closures.

Early Closures

On certain days, the stock market may close early. For example, it often closes at 1:00 p.m. ET on the day after Thanksgiving (Black Friday). These early closures are typically announced in advance, and traders should be aware of them to adjust their strategies accordingly. Knowing what time does the stock market open, and subsequently close, on these days is vital for planning.

Special Events

In rare cases, the stock market may close due to special events, such as severe weather conditions or national emergencies. These closures are usually announced by the exchanges and regulatory bodies. It’s important to stay informed about any potential disruptions to trading hours.

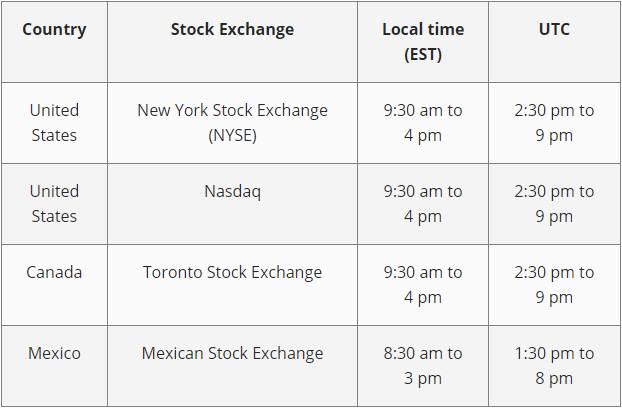

The Impact of Time Zones

Understanding the impact of time zones is crucial for international traders. The stock market’s opening hours are always referenced in Eastern Time (ET), but traders in different time zones need to adjust their schedules accordingly. For example, if you are trading from the West Coast, you need to subtract three hours from the ET opening time to determine when the market opens in your local time. This adjustment is essential for participating in pre-market, regular, and after-hours trading sessions. When considering what time does the stock market open, always factor in your local time zone.

How to Stay Updated on Market Hours

Staying informed about any changes to stock market hours is essential for effective trading. Here are some reliable sources for obtaining this information:

- NYSE and Nasdaq Websites: The official websites of the NYSE and Nasdaq provide the most accurate and up-to-date information on market hours, holiday closures, and any special announcements.

- Financial News Websites: Reputable financial news websites, such as Bloomberg, Reuters, and CNBC, provide regular updates on market hours and any potential changes.

- Brokerage Platforms: Many brokerage platforms offer notifications and alerts regarding market hours and closures.

Strategies for Trading During Different Market Hours

Different market hours offer unique opportunities and challenges. Here are some strategies for trading during pre-market, regular, and after-hours sessions:

Pre-Market Trading Strategies

- Monitor News: Stay informed about overnight news and events that may impact stock prices.

- Use Limit Orders: Due to lower liquidity and wider spreads, use limit orders to ensure you buy or sell shares at your desired price.

- Manage Risk: Be aware of the increased volatility and manage your risk accordingly.

Regular Trading Hours Strategies

- Focus on Liquidity: Take advantage of the higher liquidity and tighter spreads during regular trading hours.

- Implement Technical Analysis: Use technical analysis tools to identify potential trading opportunities.

- Stay Informed: Keep up with market news and economic data releases.

After-Hours Trading Strategies

- React to Earnings Reports: Monitor earnings reports and other news that are released after the market closes.

- Use Limit Orders: Similar to pre-market trading, use limit orders to manage risk.

- Be Cautious: Be aware of the lower liquidity and increased volatility.

The Importance of Understanding Market Hours

Understanding what time does the stock market open is more than just knowing the start and end times of trading sessions. It’s about comprehending the dynamics of different trading periods, the factors that can affect market hours, and how to adjust your trading strategies accordingly. Whether you are a day trader, swing trader, or long-term investor, knowledge of market hours is essential for making informed decisions and maximizing your investment potential. Remember to always stay updated on any changes to market hours and to consider your risk tolerance and investment goals when trading during different sessions.

In conclusion, the stock market’s regular trading hours are 9:30 a.m. to 4:00 p.m. ET. However, pre-market and after-hours trading sessions offer additional opportunities, albeit with increased risks. Staying informed about market hours, holidays, and potential disruptions is crucial for successful trading. By understanding these factors and adapting your strategies accordingly, you can navigate the stock market more effectively. Always refer to official sources for the most accurate and up-to-date information. [See also: How to Invest in Stocks for Beginners] [See also: Understanding Stock Market Volatility] [See also: Best Online Brokers for Day Trading]